Reps Panel Raises Alarm Over Exploding POS Fraud

**Says Nigerians Now “Exposed and Unprotected”

By Fatima Ndagi

The House of Representatives Ad-hoc Committee investigating the economic, regulatory and security implications of cryptocurrency adoption and Point-of-Sale (POS) operations has raised fresh alarm over what it described as an escalating wave of fraud, illicit financial flows and criminal exploitation of Nigeria’s digital-payments ecosystem.

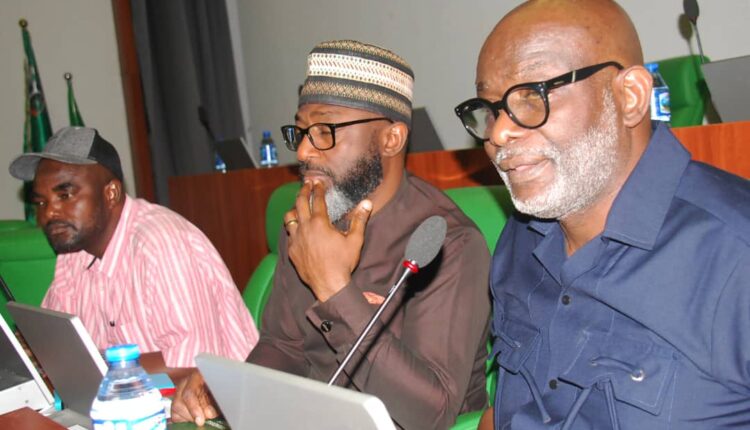

Speaking at the resumed investigative hearing in Abuja on Monday, Chairman of the Committee, Hon. Olufemi Bamisile, said evidence presented by regulators, security agencies, fintech companies and POS operators revealed “deep, dangerous gaps” in the rapidly expanding sector.

Bamisile warned that Nigerians are increasingly at risk due to unprofiled POS agents, cloned payment terminals, anonymous transactions, weak KYC compliance and unregulated crypto dealings.

“We are concerned about the growing rise in fraud associated with POS operations.

Unprofiled agents, cloned terminals and weak KYC practices continue to expose citizens to preventable dangers,” he said.

Bamisile said the Committee had received credible intelligence indicating that many POS agents were already conducting cryptocurrency transactions — an activity they are not licensed to perform, adding that such practices undermine consumer protection and constitute a national-security threat.

“Some POS operators now provide crypto-related services for which they are not licensed. This raises serious red flags around anti–money laundering, terrorism financing and data integrity,” he said.

He added that the Committee had also uncovered the existence of fake companies registered with stolen NIN and BVN details, which are allegedly used to open accounts and launder illicit funds through unverified POS channels.

Another “dangerous gap”, Bamisile said, is the storage of sensitive customer data on foreign servers by some leading fintechs — a practice that severely limits the ability of security agencies to track suspicious transactions.

“This has direct national-security implications, especially in a sector already linked to terrorism financing and cyber-enabled crimes,” he warned.

Despite the alarming revelations, Bamisile stressed that the inquiry is not hostile to operators, acknowledging that the sector’s explosive growth had overwhelmed regulators.

He assured that the Committee’s recommendations would focus on harmonised regulations, stronger security safeguards, consumer protection and a stable environment for innovation.

National President of the Association of Digital Payment and POS Operators of Nigeria (ADPPON), Paul Okafor, told lawmakers that the POS ecosystem is now in a full-blown crisis, warning that fraud has reached levels that pose a direct national-security threat.

He said the number of POS agents in Nigeria jumped from 50,000 in 2017 to over 2.3 million today, while the regulatory capacity of agencies such as the Central Bank of Nigeria (CBN) expanded by “less than 10 percent”.

“This imbalance is what has produced the crisis we are facing today,” he said. “The regulators are not incompetent — they are overwhelmed by the speed and scale of growth.”

Citing data from the Nigeria Inter-Bank Settlement System (NIBSS), Okafor said fraud across digital-payment channels rose from ₦17.67 billion in 2023 to ₦52.26 billion in 2024 — an increase of ₦34.59 billion within one year.

He added that attempted fraud jumped by 338 percent, with POS channels alone responsible for 26.37 percent of all cases.

FITC also reported a 95 percent spike in POS fraud in Q4 2024, with over 38,000 cases officially reported — and more than 70,000 unreported.

Okafor said security reports show that POS terminals have become a major cash-out channel for criminal gangs:

“In some states, nearly 40 percent of kidnap ransom payments pass through informal POS agents. This is no longer a fintech issue — this is a national-security threat.”

The association proposed three urgent reforms to sanitise the sector and strengthen national security, calling for the introduction of a mandatory Police–NCCC Cybercrime Clearance Certificate for all POS operators, compulsory CAC registration for every POS business, and enforced membership in recognised trade associations to ensure proper training, discipline, and effective self-regulation.

Okafor said similar reforms in India, Brazil, South Africa and Kenya dramatically reduced agent-related fraud.

Okafor urged lawmakers to act with urgency:

“If we fail to act, fraud will escalate, kidnappers will continue to exploit the system, Nigerians will lose more money, and trust in the financial system will be destroyed. And when trust dies, the financial system dies.”

The Committee will continue to interface with regulators, operators and security agencies before submitting its final report.